Contents:

The Fund’s investments are subject to changes in general economic conditions, general market fluctuations and the risks inherent in investment in securities markets. The Fund is subject to the risk that geopolitical events will disrupt securities markets and adversely affect global economies and markets. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, or other events could have a significant impact on the Fund and its investments. In the current bond market environment, low yields are causing high-income investors to look in other areas for yield. As with all stocks, you may be required to deposit more money or securities into your margin account if the equity, including the amount attributable to your ETF shares, declines.

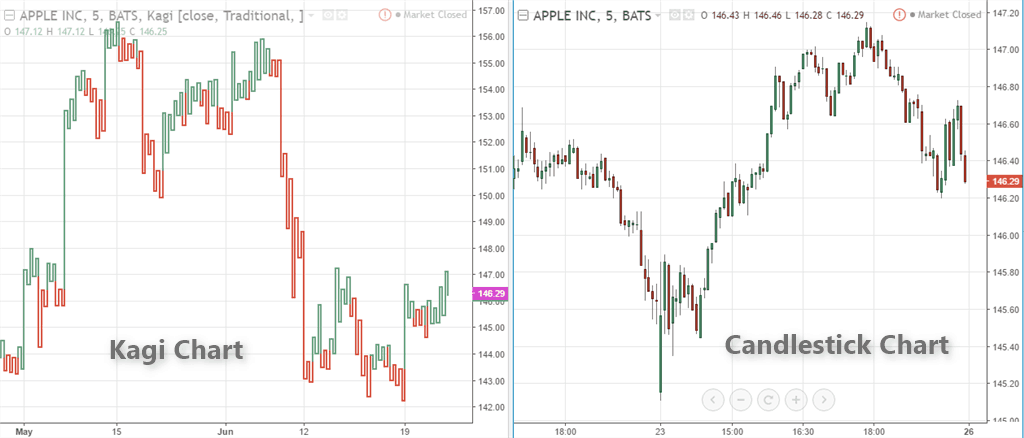

Intraday Data provided by FACTSET and subject to terms of use. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. The products and services described on this web site are intended to be made available only to persons in the United States or as otherwise qualified and permissible under local law. Nothing contained in or on the Site should be construed as a solicitation of an offer to buy or offer, or recommendation, to acquire or dispose of any security, commodity, investment or to engage in any other transaction.

Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. The median of those values is identified and posted on each business day. Represents the volume of shares traded on the ETF’s primary exchange throughout the previous business day. The market value of a mutual fund’s or ETFs total assets, minus liabilities, divided by the number of shares outstanding. Information is provided ‘as is’ and solely for informational purposes, not for trading purposes or advice, and is delayed.

Alternative ETFs in the ETF Database Technology Equities Category

Investors may acquire ETFs and tender them for redemption through the Fund in Creation Unit Aggregations only. The Morningstar information contained herein is proprietary to Morningstar or its affiliates; may not be copied or redistributed; and is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Bloomberg Barclay’s uses an evenly weighted blend of a security’s Moody’s, S&P, and Fitch rating rounded down to the lower rating in the case of the composite being between two ratings. In the case where a security has no rating, an issuer rating may be used to determine index classification. Bloomberg Barclays Index breakdowns are grouped into larger categories.

We find that high-quality management teams deliver superior performance relative to their benchmarks and/or peers. Get our overall rating based on a fundamental assessment of the pillars below. State Street Global Advisors Funds Distributors, LLC is the distributor for some registered products on behalf of the advisor.

ETF Trends and ETF Database , the preeminent digital platforms for ETF news, research, tools, video, webcasts, native content channels, and more. The ETF Trends and ETF Database brands have been trusted amongst advisors, institutional investors, and individual investors for a combined 25 years. The firms are uniquely positioned to aid advisor’s education, adoption, and usage of ETFs, as well as the asset management community’s transition from traditionally analog to digital interactions with the advisor community. A fund’s Morningstar Rating is a quantitative assessment of a fund’s past performance that accounts for both risk and return, with funds earning between 1 and 5 stars.

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. After-tax returns are calculated based on NAV using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

A portion of the dividends you receive may be subject to federal, state, or local income tax or may be subject to the federal alternative minimum tax. Click on the « Performance & Risk » link to view quarter-end performance. Average annual total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative total returns are reported as of the period indicated. Life of fund figures are reported as of the commencement date to the period indicated. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV- the returns calculated using market price can differ from those calculated using NAV .

Historical Trading Data

A shortcut to view the full list of positions in your portfolio? Perfect for the technical trader, this indicator captures an ETF’s technical events and converts them into short-, medium-, and long-term sentiment. Sign Up NowGet this delivered to your inbox, and more info about our products and services. SHM has a dividend yield of 0.77% and paid $0.36 per share in the past year. The dividend is paid every month and the last ex-dividend date was Apr 3, 2023. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.

To see all https://1investing.in/ delays and terms of use, please see disclaimer. ETF Database analysts have a combined 50 years in the ETF and Financial markets, covering every asset class and investment style. The team monitors new filings, new launches and new issuers to make sure we place each new ETF in the appropriate context so Financial Advisors can construct high quality portfolios. View charts that break down the influence that fund flows and price had on overall assets.

ETF / ETP Details

This section compares the dividend yield of this ETF to its peers. Free commission offer applies to online purchases select ETFs in a Fidelity brokerage account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). There are currently no news stories available for this symbol. Please note you can display only one indicator at a time in this view.

Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401 plans or individual retirement accounts. The adjacent table gives investors an individual Realtime Rating for SMH on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. The « A+ Metric Rated ETF » field, available to ETF Database Pro members, shows the ETF in the Technology Equities with the highest Metric Realtime Rating for each individual field. ETFs are subject to market fluctuation and the risks of their underlying investments.

Any data, charts and other information provided on this page are intended to help self-directed investors evaluate exchange traded products , including, but limited to exchange traded funds and exchange traded notes . Criteria and inputs entered, including the choice to make ETP comparisons, are at the sole discretion of the user and are solely for the convenience of the user. Analyst opinions, ratings and reports are provided by third-parties unaffiliated with Fidelity. Fidelity does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating ETPs.

SPDR® Nuveen Blmbg ST MunBd ETF

Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. An annualized yield that is calculated by dividing the net investment income earned by the fund over the most recent 30-day period by the current maximum offering price that does not account for expense ratio waivers. The municipal market is volatile and can be significantly affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal securities. Interest rate increases can cause the price of a debt security to decrease.

Our team at ETF Database is committed to making our website the premier source of information on ETF investing with the world’s highest quality ETF tools, content, and resources. Below is a look at ETFs that currently offer attractive buying opportunities. Fact sheets are issued by the ETF provider and framed by ETF Database. Information contained within the fact sheet is not guaranteed to be timely or accurate. When autocomplete results are available use up and down arrows to review and enter to select.

Morningstar Analyst Rating

SSGA Funds Management, Inc. has retained Nuveen Asset Management as the sub-advisor. State Street Global Advisors Funds Distributors, LLC is not affiliated with Nuveen Asset Management. Performance returns for periods of less than one year are not annualized. © 2023 Market data provided is at least 15-minutes delayed and hosted by Barchart Solutions.

As always, this rating system is designed to be used as a first step in the fund evaluation process. A high rating alone is not sufficient basis upon which to make an investment decision. Because ETFs trade like stocks at current market prices, shareholders may pay more than a fund’s NAV when purchasing fund shares and may receive less than a fund’s NAV when selling fund shares. An annualized yield that is calculated by dividing the net investment income earned by the fund over the most recent 30-day period by the current maximum offering price.

VanEck Semiconductor ETF

Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from their use. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation and other individual factors and re-evaluate them on a periodic basis. The SPDR Nuveen Bloomberg Short Term Municipal Bond ETF is an exchange-traded fund that mostly invests in investment grade fixed income.

Index what is ecommerce are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable. The market value-weighted average maturity of the bonds and loans in a portfolio, where maturity is defined as the stated final for bullet maturity bonds and loans. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your shares. Current performance may be higher or lower than the performance data quoted.

- News, commentary and events are from third-party sources unaffiliated with Fidelity.

- The dividend is paid every month and the last ex-dividend date was Apr 3, 2023.

- Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund.

Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. Verify your identity, personalize the content you receive, or create and administer your account. We’d like to share more about how we work and what drives our day-to-day business. The Parent Pillar is our rating of SHM’s parent organization’s priorities and whether they’re in line with investors’ interests. The People Pillar is our evaluation of the SHM management team’s experience and ability.

XLU ETF: Not Your Grandmother’s ETF Anymore – Seeking Alpha

XLU ETF: Not Your Grandmother’s ETF Anymore.

Posted: Fri, 24 Sep 2021 07:00:00 GMT [source]

The Federal Reserve showed just how important the bond market is by purchasing debt-focused exchange-traded funds , but one area they didn’t focus on was the municipal bond market. Before investing in any exchange traded product, you should consider its investment objective, risks, charges and expenses. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information.

Past performance is not a reliable indicator of future performance. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Performance of an index is not illustrative of any particular investment. All results are historical and assume the reinvestment of dividends and capital gains. An option-adjusted measure of a bond’s (or portfolio’s) sensitivity to changes in interest rates calculated as the average percentage change in a bond’s value under shifts of the Treasury curve +/- 100 bps. Incorporates the effect of embedded options for corporate bonds and changes in prepayments for mortgage-backed securities.

Français

Français